Determining the Goodwill Value for Entrepreneurs with the Multi-Attribute Utility Model

Executive Summary

The Problem:

The components of Goodwill can be challenging to measure objectively, but doing so in several valuation scenarios is critical. The Multi-attribute Utility Model provides the simplest and most efficient means of determining the value of the components of Goodwill.

The Solution:

The MUM is an allocation model for distinguishing enterprise goodwill from personal goodwill. It is a well-defined method used in many disciplines—economic, political, and scientific—to establish decision support for subjective problems.

The MUM lends itself to consistency, introduces objectivity into an otherwise subjective assignment, and provides for sensitivity analysis of the outcome.

The objective of using the MUM method is to distinguish the value of personal and enterprise goodwill from total goodwill, such that a well-founded basis for the allocation can be formed and communicated.

The Process Made Easy:

Define an Objective

Establish Alternatives

Define the Attributes

Measure the Utility of Each Attribute

Aggregate the Results

Evaluate the Alternatives

Express an Opinion

The Issue at Hand

The characterization of “value” between personal and enterprise goodwill is becoming an increasingly important business valuation issue. The characterization is often a factor in corporate taxation where the source of proceeds from a sale or liquidation can be considered personal goodwill and therefore not subject to corporate taxation. Characterization of goodwill is primarily true for marital estate dissolution disputes, where an increasing number of states are requiring a separation of personal versus enterprise goodwill and excluding personal goodwill from the marital estate.

Segregating the intangible value of a company between personal and enterprise goodwill is often a daunting valuation task. This does not have to be the case. A Multi-attribute Utility Model (MUM) provides a simple but sophisticated method for solving this problem.

What is a Multi-attribute Utility Model?

MUM is a mathematical tool for evaluating and comparing enterprise and personal characteristics to assist in decision making about complex alternatives, especially when competing interests are involved. The MUM is designed to answer the question, “Who owns the goodwill?” The model allows a valuator to assign scores to alternative choices in a decision situation where the alternatives can be identified and analyzed. It also allows a valuator to explore the consequences of different ways of evaluating the choices. The model is based on the assumption that the apparent desirability of a particular alternative depends on how its attributes are viewed.

The MUM is an allocation model for distinguishing enterprise goodwill from personal goodwill. It is a well-defined method used in many disciplines—economic, political, and scientific—to establish decision support for subjective problems. The MUM lends itself to consistency, introduces objectivity into an otherwise subjective assignment, and provides for sensitivity analysis of the outcome. The objective of using the MUM method is to distinguish the value of personal and enterprise goodwill from total goodwill, such that a well-founded basis for the allocation can be formed and communicated.

How to Use MUM as an Effective Valuation Tool

Under the MUM method, the valuator allocates alternative percentage ranges between personal/professional goodwill and enterprise goodwill. The alternatives define the possible outcomes resulting from the application of the MUM method. The alternatives are defined as a range of percentages of personal goodwill. The enterprise goodwill is the reciprocal percentage of the personal goodwill outcome.

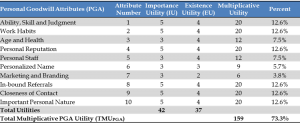

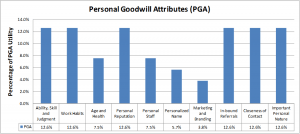

Personal Goodwill Attributes

A personal goodwill attribute (PGA) is one that is indicative of goodwill directly associated with an individual. Assessment of these attributes is a direct reflection of the consumers that seek out the individual, are referred to the individual, or repeat patronage due to the attributes of the individual as opposed to other attributes that are reflective of the business. To better understand the source and impact of the attributes, the PGAs are divided into three groups: Personal, Business, and Industry. Personal Group- Ability, Skill, and Judgment

- Work Habits

- Age and Health

- Personal Reputation

- Personal Staff

- Personalized Name

- Marketing and Branding

- In-bound Referrals

- Closeness of Contact

- Important Personal Nature

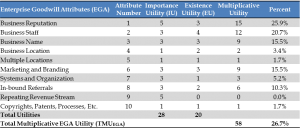

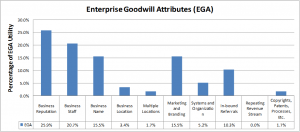

Enterprise Goodwill Attributes

An enterprise goodwill attribute (EGA) is one that is indicative of goodwill directly associated with the business. Assessment of these attributes is a direct reflection of consumers that seek out the enterprise, are referred to the enterprise, or repeat patronage due to the attributes of the enterprise as opposed to other attributes that are reflective of the individual. To better understand the source and impact of the attributes, the EGAs are separated into two groups: Business and Industry. Business Group- Business Reputation

- Business Staff

- Business Name

- Business Location

- Multiple Locations

- Marketing and Branding

- Systems and Organization

- In-bound Referrals

- Repeating Revenue Stream

- Copyrights, Patents, Processes, Etc.

Aggregate the Results

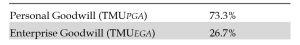

Aggregating the results is essentially performing MUM’s math. The math underlying the use of MUM in the allocation of goodwill is multiplicative. The attributes are divided into the two groups—personal and enterprise. The importance utility is multiplied by the existence utility for each attribute to determine the multiplicative utility of each attribute. The two groups, personal and enterprise, are subtotaled to provide the PGA Utility and the EGA Utility. The sum of the PGA Utility and the EGA Utility is referred to as the total multiplicative utility (TMU). The results for both groups are converted to a percent of the TMU. This represents the relative percentage of the PGAs and the EGAs to the total goodwill to be allocated. This forms the basis for the next step—evaluating and fitting the results to the alternatives.Evaluate the Alternatives

The resulting utility of the personal and enterprise goodwill components are evaluated in terms of the alternatives. This is known as sensitivity analysis to the range of alternatives. This step requires the valuator to analyze the attributes and utilities to determine the overall contribution to the result. The review & sensitivity analysis is an important step in MUM to challenge and confirm all aspects of the MUM process. This forms the basis for the conclusion of value of the separate elements of goodwill.

Qualitative Conclusions

The Industry Characteristics- In this case, the vast majority of goodwill is personal rather than attributable to enterprise goodwill. Principals in this industry source their own business based on their personal reputations and connections. The firms under which they operate have very few attributes, if any, that contribute to value in and of themselves.

- While some proportion of the commercial value of the business interests held by the Principal must be attributed to enterprise goodwill, the vast majority of the value is due to the time, toil, talent, and personal nature of the Principal.

- Without the Principal’s active involvement, the value of the ownership interests held would be significantly diminished.

- Further, the Principal is both willing and able to withdraw from the partnership in a competition scenario, taking the clientele from the partnership.

- In the event of such a competition scenario, the value of the ownership interests held would be de minimis.

ValueScope: Measuring, Defending, and Creating Value for Our Clients

ValueScope is much more than a regional valuation and damages firm. We are a national firm that also specializes in complex litigation support, tax reporting and analysis, transfer pricing between corporate affiliates, management consulting, and transaction advisory. We are here to help—please let us prove it. We look forward to speaking with you.

We look forward to speaking with you.

Steven Hastings, MBA, CPA/ABV/CFF, CGMA, ASA, CVA

PRINCIPAL